Price to earnings ratio identifies the relationship between the stock price of a company and its earnings per share. The price earnings ratio is considered by the investors to have…

Meet the weaver of words and a sorcerer of finance storyteller, Manaswi Agarwal, who can convey unfiltered data into golden nuggets. In GTF, content writing is about being a relentless researcher and conquering the digital realm through financial knowledge. With a vision of transforming mundane topics into meaningful insights and wisdom since two years, she has been constantly honing her craft while staying versed with the industry trends. She puts her knowledge in writing as a blend of creativity and craftsmanship to meet the growing landscape of content creation. Her work focuses to illuminate GTF students towards the path of stock market literacy with each word that she writes.

Price to earnings ratio identifies the relationship between the stock price of a company and its earnings per share. The price earnings ratio is considered by the investors to have…

BTST stands for “Buy Today, Sell Tomorrow” which is a trading strategy that can be highly profitable to the traders when executed with proper strategies and risk management. The strategy…

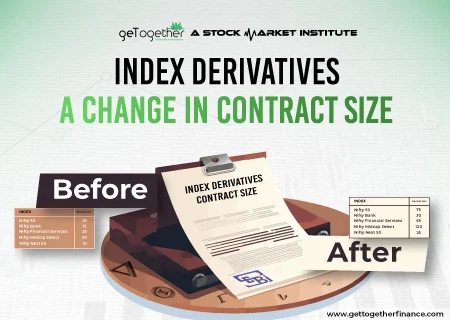

A report from SEBI shows that individual traders made net losses of Rs 1.81 lakh crore in F&O in the past three years with only 7.2% making a profit. To…

Window dressing in finance is a strategy of manipulating the reports so that it seems more appealing to the stakeholders and investors at the end of the reporting period. Generally,…

SWOT is a framework or a fundamental concept used by the company itself and the investors to evaluate a company’s overall health by analyzing its financial strength to develop strategic…

Long-term investment strategy entails holding stock for more than a year. In this strategy investors hold their assets like stocks, bonds, exchange-traded funds, mutual funds and more for a long-term…

Multi bagger stocks yield returns significantly surpassing their acquisition cost. The stocks tend to multiply the returns by indicating a company’s substantial growth potential, efficient management, and advanced production techniques….

Hedge funds are a pooled investment of a partnership firm, institution or accredited investors. Hedge funds in India do not work under the guidelines of Securities and Exchange Board of…