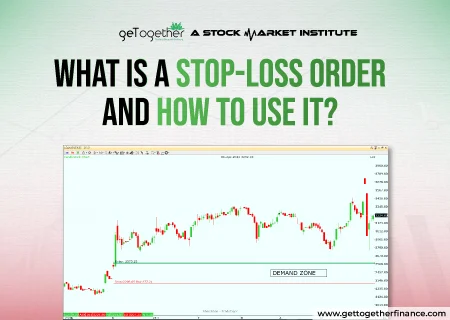

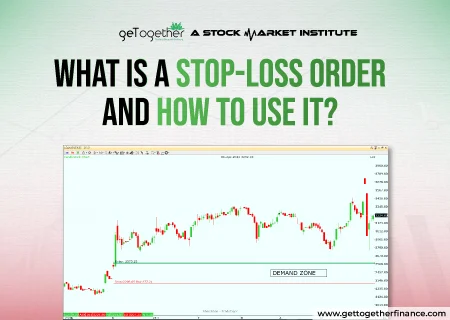

Introduction It’s never the risk that will lead you towards trouble, instead, it’s the non-calculative risk that will. Taking risks is part of stock market trading, but people get deceptive…

Bhumika Haldiya, a BBA student turned freelance writer, has evolved over 3 years into a savvy finance content creator. Initially freelancing while studying, her passion for finance inspired her to craft informative yet engaging stock market content. With a knack for simplifying complex financial concepts, she delivers articles that educate and captivate stock market geeks. Bhumika's journey from freelancer to finance writer showcases her dedication to mastering her craft and sharing valuable insights with her audience.

Introduction It’s never the risk that will lead you towards trouble, instead, it’s the non-calculative risk that will. Taking risks is part of stock market trading, but people get deceptive…

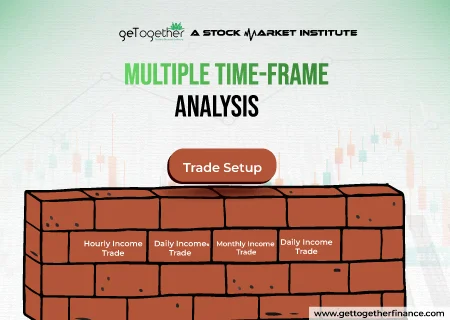

Overview Multiple Time Frame Analysis (MTFA) is an excellent technical strategy that involves analyzing the stock or security on different time frames for better accuracy. For instance, a technical trader…

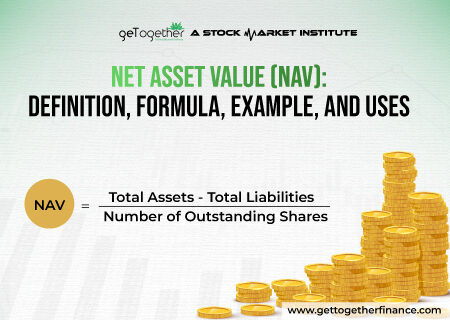

Introduction Net Asset Value is the per-share value of a fund’s assets excluding its liabilities. NAV is commonly used in assessing mutual funds and ETFs; it is calculated by dividing…

Introduction Debenture shares are certain types of debt instruments that are used by companies to raise capital. Unlike equity shares, they do not offer ownership to the buyer but instead…

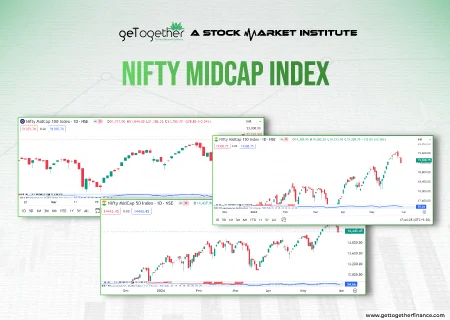

Introduction The National Stock Exchange (NSE) has created benchmarks of NIFTY to track certain segments of the stock market. These indices comprise different categories such as large-caps, small-caps, and mid-caps…

Introduction Financial parameters and metrics like ROA serve as essential tools for gauging the financial health and performance of the company. Investors, managers, and stakeholders significantly monitor how well the…

Introduction Understanding the stock market and its functionalities is crucial for every investor and trader. One of the crucial aspects of the stock market is the tax on the gains….

Managing investments while simultaneously thriving to make more money can be hectic for working professionals in today’s fast-paced world. But, investing cannot be overlooked because of this, it is an…